I admit that I’m pretty cautious when it comes to saving and investing my money. I’ve never had a lot of excess funds. As a freelancer, my income fluctuates a lot, so I like to know that I can access my money easily in case of an emergency. However, as I’ve gotten older, I’ve started to invest a little bit more. I think my next step in doing so is going to be to use TreasuryDirect.gov.

I admit that I’m pretty cautious when it comes to saving and investing my money. I’ve never had a lot of excess funds. As a freelancer, my income fluctuates a lot, so I like to know that I can access my money easily in case of an emergency. However, as I’ve gotten older, I’ve started to invest a little bit more. I think my next step in doing so is going to be to use TreasuryDirect.gov.

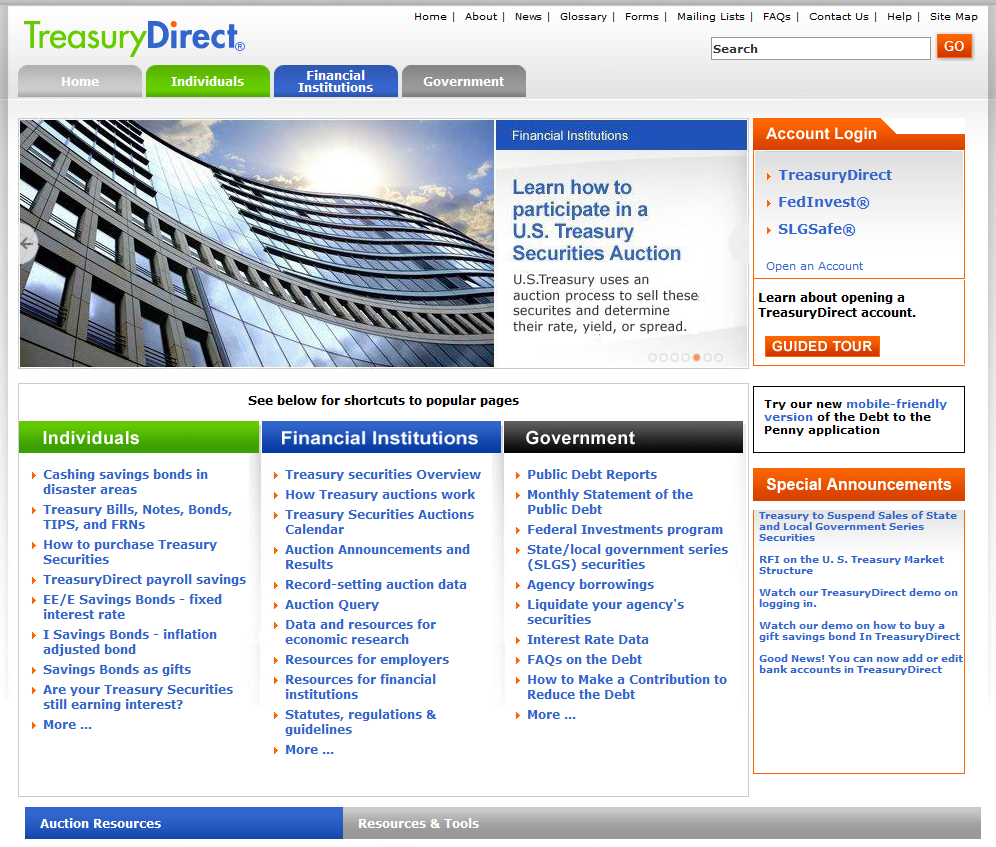

What is Treasury Direct?

TreasuryDirect.gov is an online platform to invest directly with the US government. You can use the site to invest in bonds, notes, bills, and a few other products. Since you’re working directly with the government, it’s fairly risk-free compared to other types of investments.

Beyond a Savings Account

I can earn more with this type of investment than I can with a basic savings account. It’s better than just stowing my money anyway. And yet, there is very little risk and a lot of flexibility. There are ways that I could invest that would offer a lot of what I like about a savings account.

The main thing that I’ve always been worried about is that I don’t want my money tied up for too long. In the past, I’ve invested in long-term accounts only to end up needing that money immediately. Pulling it out early cost me a lot in fees. Investing through TreasuryDirect.gov prevents that problem. You can easily invest in short-term ways that don’t tie up your money.

Why This is a Good Next Step For Me

It seems like TreasuryDirect.gov takes things to the next level beyond just a savings account and an IRA. However, it doesn’t require a significant amount of investing knowledge or time. The site itself has loads of research and information. Browsing it, I feel confident that I could figure out how to invest my money wisely here as a smart next step. Here are some of the key things that I like about it so far:

- It’s affordable. There are not any fees. The minimum to invest in savings bonds is a measly $25. That’s really low-risk to see if it’s something that I want to do with more money.

- It seems simple to get started. The whole thing happens online. I’m very comfortable with online banking and can easily set up an account. Then I can link it to my savings account. It should take less than half an hour to get going.

- I can earn more money. My savings account has a ridiculously low interest rate. It seems like I can easily earn between 2-3% using TreasuryDirect.gov. Of course, that’s a small amount if I do just start with $25. Nevertheless, if I decide I like this tool, I could move more money there, and it could make a significant difference.

- My money will be accessible. It looks like there are ways to invest in 4-week bonds – and in fact, to do so weekly – that would mean I could easily get my money back out if I needed it.

I’m a cautious investor. However, I don’t want to limit myself out of fear. I don’t want to become so concerned with keeping my money “safe” that I don’t allow it to work for me. As such, it is time to branch out into something new. I think TreasuryDirect.gov is that thing.